Author: Liz

Welcome to the monthly Property Market Update from Harrisons Homes.

With Spring in the air everything is starting to look a little more lively and that’s certainly true when it comes to the property market in and around Sittingbourne.

Across the country 2024 got off to a strong start with high levels of activity from both buyers and sellers. The coming months show no signs of slowing down and there’s a possibility that the Budget on Wednesday 6 March will unveil some surprises. If these include measures to help first time buyers, this year could really be one to remember.

Here’s a deeper dive into the recent facts and figures showing how things are going so far this year…

For sellers

It’s always true that sellers who go on the market with the right price straight away are far more likely to sell quickly.

The latest UK property benchmark figures from Rightmove reveal that demand is strong enough to see average new seller asking prices rise by 0.9% across the country last month.

The number of sales agreed is also higher than this time last year, 16% up in the first six weeks of 2024 over the same period last year. Perhaps more importantly, the figure is 3% higher than in the most recent more ‘normal’ market of 2019.

For buyers

The good news for buyers is that Rightmove reported 7% more new listings than the same time last year. However, as that’s matched by a 7% uptick in the number of buyers making enquiries it shows that although there’s certainly some choice out there you really do need to move quickly to secure the right property at the right price.

In fact, one of the trends emerging for this year looks likely to be something of a ‘two speed’ market, with homes that are priced accurately selling quickly and other overpriced properties becoming stale and staying on the market for months.

Of course it’s good news for everyone that mortgage deal rates have fallen from their peak last summer and are now staying relatively stable too. When buyers can plan affordability accurately it always follows that correctly priced properties will sell.

Facts and figures

At Harrisons we pride ourselves on being different to your average estate agent. That’s easy to say, and for us it’s easy to back up with facts and figures too.

Our latest stats show that 50% of our sales were agreed for sums above the asking price. When you take into account that one in five UK sales agreed a 10% discount on the original asking price, it really highlights what we can do for sellers.

We’ve produced a booklet that sets out our unique ’12 Step Plan To Sell For A Premium Price’ in detail – if you’d like to read it get in touch and let us know.

Our unique marketing isn’t the only thing that sets us apart – we have zero week contracts and peace of mind reservation agreements that once again prove how we mean it when we say we do things differently.

Find out more – email hello@harrisonshomes.co.uk, call us on 01795 474848 or even better pop into the office in Sittingbourne for a coffee and a chat.

All the best

Chris & the Harrisons Homes team

Author: Liz

Enter our Valentine’s competition to win a romantic glamping getaway in the heart of the Kentish countryside.

We have teamed up with Mount Ephraim Gardens to offer the chance for you to win a romantic getaway in the stunning Kentish countryside. Mount Ephraim is a country house set in 10 acres of gardens. It has been the family home of the Dawes family since 1695. Located in the picture perfect village of Hernhill, neatly nestled between the Historic Market Town of Faversham, the quaint seaside town of Whitstable and the Cathedral City of Canterbury.

Prize winners will win a glamping experience where they can explore the local area or simply relax in nature and enjoy the gardens*

Mount Ephraim offers visitors a chance to enjoy 10 acres of Edwardian gardens comprising of rose terraces, lake and water garden, Japanese rock garden and shaped topiary. There is a grass Miz Maze and a splendid arboretm, to name just a few of the highlights you can discover alongside the seasonal bulbs and mature trees you would expect to find.

To ensure you get the most out of you prize, and to give you more time to explore the gardens, we have also added two 2024 season tickets for you to visit the gardens as often as you like. the gardens are open to visit from end of March – end of Sept on Wednesdays to Sundays and Bank Holidays

*Stay must be booked during low season (1st – 28th March 2024 and 1st November 2024 – 31st March 2025)

To find out more visit Mount Ephraim Gardens

Win a romantic getaway

Win a one night stay in a Glamping Pod at Mount Ephraim Gardens and two adult season tickets to the gardens for free entry during 2024

All Photo’s courtesy of Mount Ephraim Gardens

The Valentine’s Competition.

These are the terms and conditions that govern the relationship between you, the entrant and Harrisons Homes Limited (the promoter), 2 West Street, Sittingbourne, Kent ME10 1AW

ELIGIBILITY

The competition is only open to residents in the UK. Entrants must be over the age of 18 and hold a valid email address.The following people are not eligible to enter the competition:

Employees of Harrisons Homes, Shore Way Marketing, Mount Ephraim Gardens, immediate family members and associated businesses.

Harrisons Homes assumes that by entering the competition you have the legal capacity to do so and agree to these terms and conditions.

Entries from automated competition entry sites such as Win24, WeWin4U, Prizewise, Prize500 and PrizeDrawCentre are not valid and will be disqualified.

HOW TO ENTER OUR VALENTINE’S COMPETITION

Entries can only be made online via our Facebook @HarrisonsHomes page or via Instagram @HarrisonsHomesUK account. Look for the post entitled “Win a Valentine’s treat” and follow the instructions to tag and enter.

Only one entry is allowed per person.There is no entry fee and no purchase required.

PROMOTION PERIOD

The Promotion opens on 1st February 2024 and closes at midnight 29th February 2024.

Description of the prize:

The prize consists of two adult season tickets for entry to the gardens which open on 27th March 2024 until 30th September 2024 and a night away for two in one of the newly installed Glamping Pods.

The pods feature a comfy double bed, with modern conveniences including a fully equipped kitchen and modern bathroom (don’t worry, there’s a flushing loo and hot shower!)

Key Features

- Countryside views of our family fruit farm

- Well equipped kitchen with small fridge/freezer, induction hob, kettle, toaster, pots, pans, glasses, cutlery and crockery

- Ensuite bathroom with flushing loo, hot shower and toiletries

- Comfy bed linen & fluffy towels

- Private decking area with seating overlooking the farm

- Outdoor firepit and hammock for alfresco living

- Designated parking area just a stone’s throw from the pods

- Well heated and insulated for winter stays

- Wifi

- Dog friendly

- Unlimited access to our ten acres of glorious gardens during daylight hours

- Under 10 minutes’ walk to two country pubs – The Red Lion or Three Horseshoes in Hernhill

- Teas, coffees and a couple of cooking essentials provided along with a little welcome basket with some local produce

IMPORTANT TO KNOW

Whilst our pods themselves are furnished and well equipped, the landscaping around the pods is still a work in progress being a completely new venture. We are aiming to have planted it up by late spring 2024. The pods are situated on the edge of our fruit farm adjacent to the gardens. Access to the pods with a car is down our back drive and along a bumpy farm track which can be a little muddy in winter but it has been reinforced with hardcore and is very driveable. But we are almost there, and you can relax here in comfort and enjoy everything the countryside has to offer.

T’s&C’s:

- Stay must be booked during low season (1st – 28th March 2024 and 1st November 2024 – 31st March 2025)

- Subject to availability

- The prize must be accepted as awarded and is non-transferable, and there are no cash alternatives.

- The winner is responsible for expenses and arrangements not specifically detailed in the prize. Including but not limited to; travel, insurance, extra meals, drinks, and all necessary travel documents. When issued, the accommodation cannot be re-issued or changed in any way.

- Over 18 and UK entrants only.

SELECTION OF WINNER

One (1) winner will be chosen at random from all entries no later than 1st March 2024. The winner will be selected randomly and witnessed. The decision is final and no discussion will be entered into concerning the outcome. The winner will be contacted by direct message.

GENERAL

By entering the competition you agree to be bound by these terms and conditions (which may be amended or varied at any time by us with or without notice) and by our decisions which are final and no correspondence or discussion shall be entered into.

Author: Liz

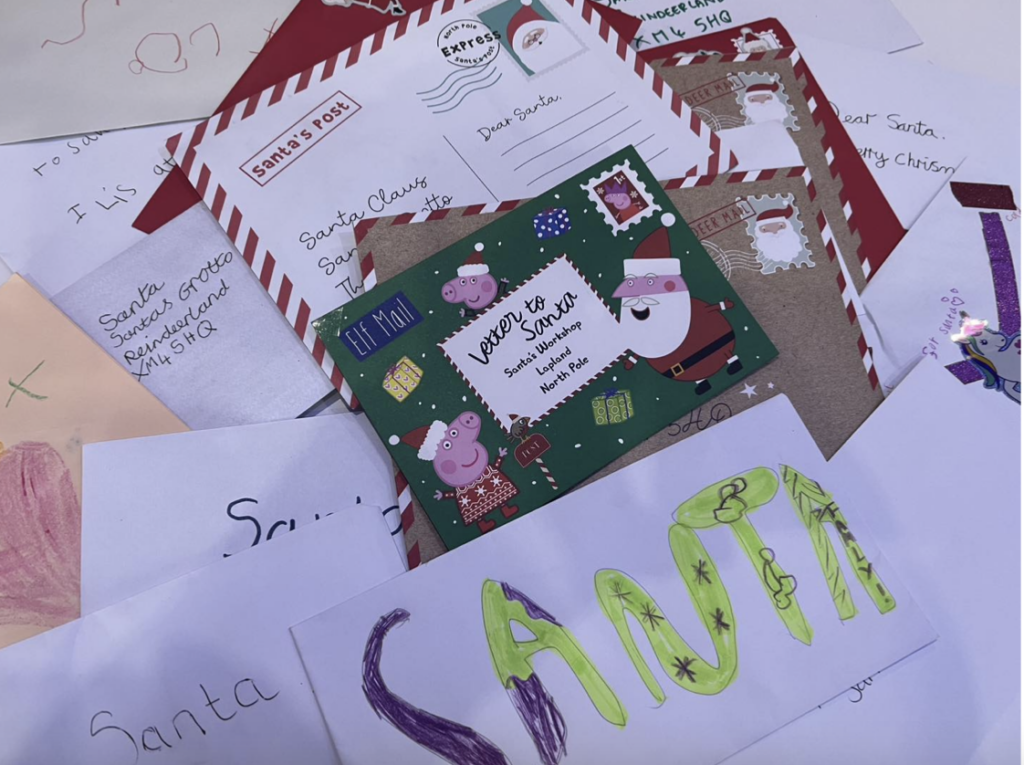

Our Write to Santa campaign that was delivered by the Harrisons Elf Service lit up the hearts and minds of so many children in Swale this year – far more than we imagined!

With 63 children writing to Santa, it’s safe to say the team at the North Pole were busy compiling their gifts and loading them onto the sleigh ready to be delivered.

So many letters!

We were so pleased to be able to hand deliver all replies to the 63 letters with the help of a few Elves. The children absolutely loved getting their replies, and to see the looks on their faces was even better – that’s what we believe Christmas is all about.

We even donated two laptops along the way!

We aren’t joking when we say every single one of those children wrote thoughtful, imaginative and kind letters to Santa, and each and every child is a credit to their parents and carers.

From Lego to sweeties, we know that many wishes were contained within Santa’s letters, and I have it on good authority that he is keeping every single one on file in his office.

What beautiful writing!

We would like to say a huge thank you to all the children and their helpers who wrote letters. Lynsted school staff informed us how enjoyable the children found it, and we would also like to personally say a big well done for the children’s beautiful writing, spelling and drawings. Santa was most impressed!

Money raised for local schools

The Write to Santa campaign raised an astonishing £350 for local schools. Thank you!

With Christmas 2023 firmly behind us now, we look forward to being able to connect Swale’s children with Santa at the end of this new and exciting year.

We are already wondering what will be on their lists!

See you next Christmas, for more Letters to Santa.

Author: Liz

Welcome to the monthly Property Market Update from Harrisons Homes.

Every January crystal balls are polished and predictions about the property market come in from all directions. Banks, building societies, surveyors, media outlets and property portals all have their own ideas about what the coming year will hold for those looking to move.

Here at Harrisons we believe in giving straight talking advice based on what’s happening in our local area, because that’s what really matters to anyone who wants to sell or buy a home.

For sellers

Last year more than a third of property transactions in the UK fell through before completing. It’s a huge statistic because the emotional effects can be heartbreaking, putting plans on hold and throwing months of work out of the window.

We offer a way to protect yourself and your sale with our reservation agreements. Once a sale has been agreed, both buyer and seller make a binding commitment to terms recommended by HM Government and underwritten by The Law Society.

We are the only estate agent in our area who recommends Reservation Agreements on every sale. Here’s some more information: https://secure.gazeal.co.uk/harrisons-homes/

For buyers

We believe in providing the best service for all of our clients and of course that includes buyers.

Today many other agents rely too heavily on property portals to market and sell homes. We really get to know our buyers and understand their needs. This means we have serious buyers ready to view, in a position to make offers on the homes we sell.

It’s also how we start matching buyers with properties even before they ‘go live’ on Rightmove and other websites. Our unique Heads Up Registration Service is just one of the ways we are proud to be different while avoiding using any gimmicks.

More details here: https://bit.ly/353SZpS

Get moving in 2024!

Both sales and demand across the UK were almost a fifth higher in the final weeks of 2023 than they were the previous year. Add to that average mortgage rates having fallen for 19 consecutive weeks and we enter 2024 with things looking very positive for all sides of the market.

So if you’re looking for the best advice and service to help you sell, buy, rent or let a home in Sittingbourne and the surrounding areas, email hello@harrisonshomes.co.uk or call us on 01795 474848 and let us help make this a very Happy New Year for you!

All the best

Chris & the Harrisons Homes team

Author: Liz

Buying a home is a big decision, but what if you fell in love with a home that was said to be haunted?

It’s not something that estate agents have to think about too often, but some houses are harder to sell than others, due to some buyers superstitions. For example houses numbered 13 or properties near a graveyard, But what if the house you want to buy comes with a ghostly fixture?

Would this put you off putting in an offer on your dream home? We think there are a few pluses to buying home with a spirit in residence. Let us know what you think?

You could save money ![]()

If a house is considered haunted, in a spooky location or a number 13, it’s going to put some buyers off. By having less people in the running for the home of your dreams, you may be able to get it for a bargain price.

That homely feeling ![]()

Not all spirits are bad. Having a ghost in residence, doesn’t mean your furniture will start flying around or things will go bump in the night.

We use the strapline “A house is a building, A home is a feeling” Many buyers report having a feeling, or a sense that they are ‘coming home’ when they view the house of their dreams. What if that feeling is partially due to a spirit that has been waiting for someone like you to come and share their space? It could be like having a ghostly roommate.

A fantastic project ![]()

A haunted house makes for a great research project – assuming you want to know what’s behind the haunting. It’s something you can involve your whole family in. Finding out the history of your home can be addictive, even without a resident ghost. You can find information out from local libraries and museums. Join local social media groups. Talk to your new neighbours and community to find out what they know.

![]()

Who doesn’t want to visit a “haunted house” for Halloween? If you have a spiritual resident or two, why not embrace them. Get the pumpkins carved, the decorations out and invite some friends and neighbours over to have some spooky fun.

There you have it. We know there is a buyer for every home. So, the question is, would you buy a haunted house?

Author: Liz

You may have noticed something spooky has been happening in West Street Sittingbourne this week. We’d had the lovely and talented Cadell from Studio Lockington create us a Halloween themed window display. It’s already created quite a stir with passersby, especially the children who point and smile as they walk past.

To celebrate Halloween, we will be giving out sweets to any passing trick or treaters that pop into our office to show us their creepy costumes on Friday 27th October or on Halloween itself, on Tuesday 31st October.

Author: Liz

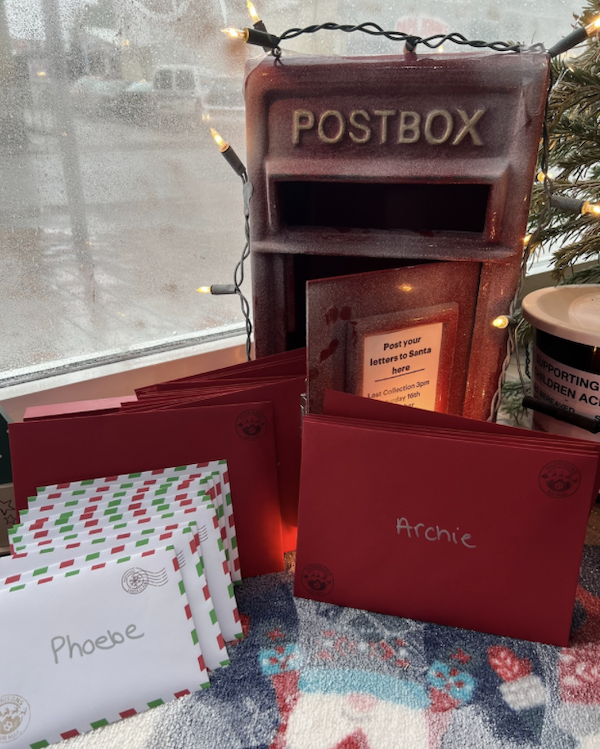

For the month of December the team here at Harrisons are set to officially become some of Santa’s little helpers, as we will be hosting one of Santa’s post boxes that will magically send any letters posted inside direct to the North Pole for Santa’s elves to open, record, pass to Santa and to take down his reply.

Every child that posts a letter in our postbox will receive a personal response direct from Santa himself.

If you, or someone you know would like to receive a letter from Santa this Christmas, here is how you can take part:

- Write your letter to Santa. Remember to tell him about something you did well this year, and what you would like for Christmas. We know that Santa also likes to hear about what you like about Christmas, how you will be celebrating and with who, or anything else you would like to share.

- Include your first and last name in the letter, so that the elves can make sure each reply goes to the right person.

- Visit our office at 2 West Street, Sittingbourne, ME10 1AW to post your letter directly into our special Santa postbox. If our office is closed, you can put letters through our letterbox and we will post them on your behalf.

- Post no later than 16th December 2023

- Collect your personalised letter from Santa from our office from 19th December 2023

Author: Liz

How to sell your home behind the scenes for over asking price.

We took on this property in Mickett Gardens, Sittingbourne is a stunning four bedroom detached family home recently. As we do with all our properties, we showed this home to our pre-qualified buyers that are registered via our unique “Heads Up Property Alerts Service” before the property details go “live” by being published to the portals such as Rightmove or On The Market.

This resulted in viewing requests and an over asking price offer made and accepted before the property went live. Not only that, all parties have peace of mind that the house sale is secured with a reservation agreement being in place.

Author: Liz

We recently sold a property in an area that had very similar properties for sale, valued at the same price that are not selling. We received multiple viewings and an offer was agreed within 24 hours of going onto the open market.

The Property:

The property is a modern three bedroom semi detached home in Sittingbourne. With two bathrooms and a pretty landscaped garden, that is in lovely condition. The property had been valued at £325,000.

The Problem:

The vendors needed to move, and to achieve as close the £325,000 as possible in order to make their next next step. The problem was that in their local area there were three similar properties on the market, in a similar condition that were priced at £325,000. These properties have been on the market for some time, without going under offer.

The Solution:

We had two options, we could try it on the market at, or around £325,00, see if it got any interest. If it didn’t, we could reduce the price and try again. However, we felt with so many properties on the market and not selling, this would not be an effective strategy to get the best price for these vendors.

We felt that a more effective approach would be to market the property for offers in the region of £300,000 and £325,000. This would reach more buyers as it reached over a number of price points. It would also make our property seem very attractive as it was potentially £25,000 cheaper than anything similar that was on the market in the local area. We were confident that we could negotiated any low offers to, or above the price the vendors would accept.

The Result:

Within 24 hours of this property coming onto the market, it had received five viewings and two offers, both well above the lower range of the asking price. We finally negotiated an accepted offer which was in the upper end of the price range, and well above, the asking price if we had listed it for £325,000 originally and then had to reduce the asking price.

Try a marketing solution that gets results:

If you are considering moving, and are concerned about how you may get the best price for your property in the current market, have a chat to the team at Harrisons about a free, no obligation Marketing Advice Meeting, to give you a clear marketing strategy for getting the best price for your home. Call us today on 01795 474848.

Author: Liz

In the current market, reducing your asking price can be the difference between receiving multiple offers and agreeing a sale. Or having to chase the market by making a series of reductions.

In our recent blog “How to move home in the current housing market” we talked about why it it is so important to be proactive about ensuring your home is priced competitively. We also covered why reducing the asking price by less than 10% isn’t going to attract viewings or competitive offers. We recently agreed a sale on a property, that is a perfect example of how a proactive approach to adjusting your asking price can make a real difference to a sale.

Case Study: Reducing your asking price

On the 19th June 2023 we began marketing a three bedroom, end terrace home in Sittingbourne with an asking price of £325,000

During the crucial first two weeks of marketing, the property attracted very little interest, despite the team at Harrisons putting a huge effort to gain interest and book viewings. There was nothing wrong with the property itself, we knew it had to be down to price.

During those first two weeks of marketing, we had several conversations with the property owners with regard to reducing their asking price. At first they felt it was to early to reduce, until we explained how important the first few weeks are if you want to get the best price for your property. The owners wanted to move, they decided to take our advice and asked to reduce the asking price to £315,000.

However, we didn’t feel this was right, a reduction of less than 5% would not attract any interest. Additionally buyers who use the online property portals create their search profile and set the filters according to their budget. The portal price parameters go up in increments, in this case the maximum price filters available are £300,000 and £325,000, When you are considering a reduction, you want as many buyers as possible to see it, buy reducing to £315,000 you are not reaching buyers looking in a different price bracket or generating any new interest in your property.

On the 4th July we agreed a price reduction to offers in the region of £300,000, we understood that the owners hoped to achieve around £315,000 on their sale.

The reduction had and instant impact, with the first offer coming in on the 6th July for £295,000, which was rejected. In the days that followed we had a flurry of new offers with two buyers bidding against each other. Until, on the 10th of July 2023, we agreed a sale with an offer of £315,000, which was the price the owners wanted from the start.

From listing to sold subject to contract, the whole process took just 22 days! If you are being told that houses aren’t selling at the moment, this isn’t true, houses priced competitively are still selling, and selling quickly, often for over the asking price.

If you want to move, ask the Harrisons team about how we can help 01795 474848

If you are being told that houses aren’t selling at the moment, this isn’t true, houses priced competitively are still selling, and selling quickly, often for over the asking price