Comparing Agents

Comparing Agents

2 years ago

Comparing Agents | Help to sell | Helpful advice | Thinking of Selling | June 29, 2023 | Liz

With the announcement last week from the Bank of England that the base rate is rising from 4.5 to 5%, this can cause a lot of worry and confusion for anyone trying to hoping to buy or sell a home. With this in mind, we thought we would take a moment to explain what we are seeing in the Swale Housing Market currently, how we think this may impact property sales in the short term and what you can do to ensure you are able to move regardless.

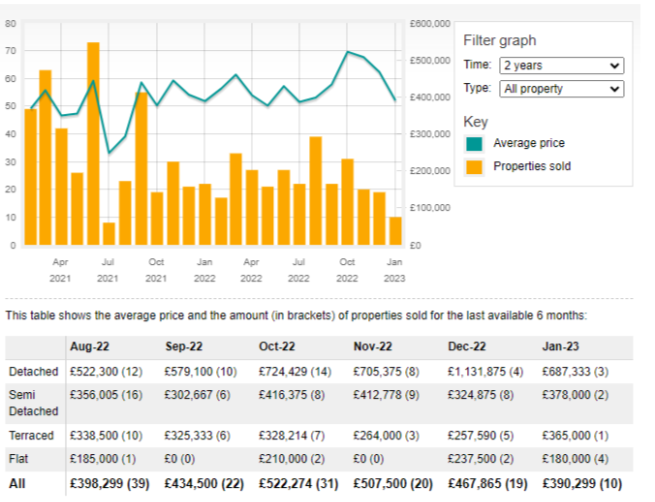

The mainstream media may have you thinking the property market is on the verge of collapse, this simply isn’t true, many parts of the UK, particularly in the North, are still seeing house prices increasing. For us in the South East, who are in much closer proximity to London, we are seeing prices adjusting, whilst it feels that house prices are falling, they have only dropped back to the pricing in July 2021 (see chart).

The average UK home has risen in value by £48 a day since February 2020. That’s equivalent to £38,000 and higher that the average UK salary.

The whole of the Swale property market has out performed this, with ME9 postcode increasing by £78 a day (£62,000) for the same period.

In truth, parts of the local market are struggling. If you are trying to sell a home over £500,000, you will need to have a strong marketing strategy and be realistic, and proactive in how you negotiate offers.

Fall through rates (sales that were agreed and one party withdrawing from the sale) are rising. Currently over a third of all sales don’t make it to completion, however if you use a reservation agreement, this figure drops significantly.

Before you despair, it’s not all doom and gloom, there are pockets in the Swale housing market that are holding up well, with many properties still receiving multiple offers, and many agreeing a sale over asking price. We have also noticed an increase in buyers registering for our Heads Up Property Alerts Service. The biggest group of these are first time buyers, we are also encouraged to see London buyers returning.

Here are a few of our top tips of how to secure a sale in the current Swale housing market

If you would like some honest, straight forward advice as to how you can sell your home, contact the Harrisons team on 01795 474848